OPEC+'s Delayed Oil Production Hike: A Strategic Gamble

Navigating a Global Energy Shift with Economic and Geopolitical Implications

The global energy sector is witnessing another strategic maneuver as OPEC+, the alliance of both OPEC and non-member oil-producing countries, defers its planned increase in oil production.

This decision emerges amidst projections of weaker demand and burgeoning competition from non-allied producers, spotlighting a complex economic and geopolitical web that oil-dependent nations must navigate.

For Saudi Arabia, this decision is multifaceted.

By refraining from amplifying production, Riyadh can maintain elevated oil prices, thus financing ambitious diversification initiatives such as the Neom project—an endeavor crucial for a post-oil economy.

However, this strategy also bears risks.

In a world increasingly intent on reducing fossil fuel reliance, holding back output could mean ceding market share to other players like Brazil or the United States.

Russia, another central player within OPEC+, faces a different dynamic.

Oil revenues are more than just economic oxygen; they are entwined with Moscow's geopolitical ambitions, notably in Ukraine.

Limiting output paradoxically keeps oil prices buoyant, thereby bolstering its coffers.

This duality underscores the delicate balance each nation attempts to strike between economic necessity and geopolitical ambition.

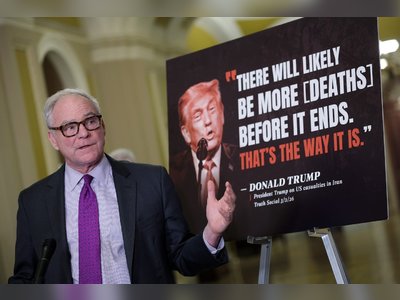

The United States, under the influence of then-President Donald Trump’s administration, signaled a potential surge in domestic drilling.

Such a move could inundate the market, undermining OPEC+’s pricing strategy.

Increased American oil could serve as a balm for inflation but risks unsettling global markets if prices plummet excessively.

Moreover, the unpredictable trajectory of global demand, with China as a potential variable, adds another layer of uncertainty.

Within this arena, OPEC+ must continually recalibrate its approach, deftly balancing economic indicators with geopolitical factors.

As these energy titans negotiate divergent, and sometimes conflicting, national interests, the central question remains: How can these strategic moves influence the future of global energy and our interconnected world?

Ultimately, this saga is more than just about hydrocarbon supply and demand.

It is about strategic alignments and the formidable influence energy exerts on the global stage, composed of a sophisticated geopolitical chess game with far-reaching implications for the future.

This decision emerges amidst projections of weaker demand and burgeoning competition from non-allied producers, spotlighting a complex economic and geopolitical web that oil-dependent nations must navigate.

For Saudi Arabia, this decision is multifaceted.

By refraining from amplifying production, Riyadh can maintain elevated oil prices, thus financing ambitious diversification initiatives such as the Neom project—an endeavor crucial for a post-oil economy.

However, this strategy also bears risks.

In a world increasingly intent on reducing fossil fuel reliance, holding back output could mean ceding market share to other players like Brazil or the United States.

Russia, another central player within OPEC+, faces a different dynamic.

Oil revenues are more than just economic oxygen; they are entwined with Moscow's geopolitical ambitions, notably in Ukraine.

Limiting output paradoxically keeps oil prices buoyant, thereby bolstering its coffers.

This duality underscores the delicate balance each nation attempts to strike between economic necessity and geopolitical ambition.

The United States, under the influence of then-President Donald Trump’s administration, signaled a potential surge in domestic drilling.

Such a move could inundate the market, undermining OPEC+’s pricing strategy.

Increased American oil could serve as a balm for inflation but risks unsettling global markets if prices plummet excessively.

Moreover, the unpredictable trajectory of global demand, with China as a potential variable, adds another layer of uncertainty.

Within this arena, OPEC+ must continually recalibrate its approach, deftly balancing economic indicators with geopolitical factors.

As these energy titans negotiate divergent, and sometimes conflicting, national interests, the central question remains: How can these strategic moves influence the future of global energy and our interconnected world?

Ultimately, this saga is more than just about hydrocarbon supply and demand.

It is about strategic alignments and the formidable influence energy exerts on the global stage, composed of a sophisticated geopolitical chess game with far-reaching implications for the future.