The Fragility of Dollar Dominance: A System Under Siege by BRICS

For decades, the United States dollar has reigned supreme as the cornerstone of the global financial system. It underpins international trade, facilitates investment, and sustains the unparalleled economic and geopolitical influence of the United States. Yet, the dollar’s dominance is increasingly under scrutiny, and recent developments from the BRICS bloc—Brazil, Russia, India, China, and South Africa—signal that this hegemony may not last forever.

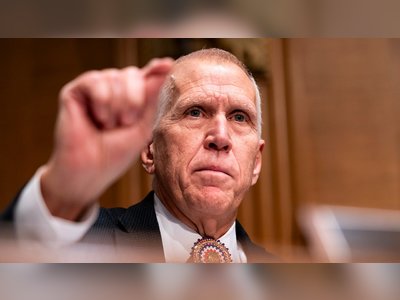

United States President-elect Donald Trump’s recent warning to BRICS nations—threatening punitive one-hundred percent tariffs if they pursue an alternative to the dollar—highlights the urgency of the moment. Trump’s rhetoric underscores not only the United States' deep reliance on the dollar’s global dominance but also the fragility of a system built on faith rather than intrinsic value.

The Dollar: America’s Most Valuable Export

Unlike other economic superpowers, the United States has leveraged its currency as its most valuable export. The dollar is not backed by gold, commodities, or other tangible assets. Instead, its value is sustained by global trust and widespread acceptance as the world’s reserve currency. This unique position allows the United States to print money at will, trading self-printed dollars for goods and services from across the globe.

For the United States, this arrangement has created an unparalleled economic advantage. The dollar’s status enables the country to consume more than it produces, sustain trade deficits, and fund its expansive military and geopolitical endeavors without the same economic consequences faced by other nations. But this privilege comes at a cost: over-reliance on a currency system that, if challenged, could unravel the very fabric of the United States economy.

The BRICS Challenge: An Emerging Threat

The BRICS nations are no longer content to be bound by the dollar-centric system. With economic and political grievances mounting, they have explored the creation of a unified currency or a framework for trading in alternative currencies such as the yuan or ruble. While the logistics of implementing such a system are fraught with challenges—including the disparate economic models and strategic priorities of BRICS members—the intent is clear: to break free from the dollar’s grip.

Trump’s threats to impose tariffs on BRICS nations highlight Washington’s growing unease. By punishing nations that seek to undermine the dollar, the United States hopes to stave off the inevitable. Yet this strategy reeks of desperation. The BRICS bloc has economic resilience that the United States cannot easily counter. China, the world’s manufacturing hub, has already diversified its trade networks through its Belt and Road Initiative. India, a global leader in IT and services, has cultivated ties beyond Western markets. Russia, despite sanctions, maintains its grip on Europe’s energy supply. Even Brazil and South Africa, with their resource-driven economies, have alternatives to United States trade.

A One-Sided Dependency

While the United States dollar’s dominance gives Washington unparalleled power, it also exposes a critical vulnerability: the United States’ dependency on BRICS imports. From consumer goods supplied by China to critical minerals and energy resources from South Africa, Brazil, and Russia, the United States economy is fundamentally reliant on the very nations Trump is threatening.

Conversely, BRICS nations can reorient trade toward regional partners and emerging markets. This one-sided dependency leaves the United States in a precarious position. If BRICS nations decide to act collectively, the dollar’s fall would not just be a symbolic loss; it would trigger a seismic shift in the global economic order.

The Risks of Overreach

The United States has long weaponized its currency dominance to impose sanctions and exert control over the global financial system. But this overreach has driven many nations to seek alternatives, accelerating efforts to reduce dependency on the dollar. Recent moves by BRICS to trade in local currencies and increase gold reserves are early indicators of this shift.

If the dollar loses its reserve currency status, the consequences for the United States would be catastrophic. Without the ability to print money freely and sustain deficits, the country would face a harsh economic reckoning. Inflation would skyrocket, import costs would soar, and the United States would be forced to confront its chronic trade imbalance.

An Unsustainable Privilege

The dollar-centric system was never meant to last forever. It is, fundamentally, an arrangement sustained by faith. As BRICS and other nations grow weary of subsidizing the United States economy through this system, the cracks in the dollar’s dominance are becoming harder to ignore.

The United States must recognize the risks of its current path. Instead of doubling down on threats and sanctions, it should seek to reform its approach to global trade and finance. Cooperation, transparency, and fair competition—not coercion—are the keys to sustaining influence in a multipolar world.

The End of Dollar Hegemony?

The challenges posed by BRICS to the United States dollar are a wake-up call. For too long, the United States has relied on its currency dominance to mask structural economic vulnerabilities. As the world moves toward greater financial diversification, the dollar’s monopoly on global trade is under threat.

The fall of the dollar would not just mark the end of an era—it would fundamentally reshape the global order. Whether the United States can adapt to this new reality remains to be seen. One thing is certain: the days of unchecked dollar dominance are numbered, and the United States must prepare for a world where its currency is no longer king.

The Dollar: America’s Most Valuable Export

Unlike other economic superpowers, the United States has leveraged its currency as its most valuable export. The dollar is not backed by gold, commodities, or other tangible assets. Instead, its value is sustained by global trust and widespread acceptance as the world’s reserve currency. This unique position allows the United States to print money at will, trading self-printed dollars for goods and services from across the globe.

For the United States, this arrangement has created an unparalleled economic advantage. The dollar’s status enables the country to consume more than it produces, sustain trade deficits, and fund its expansive military and geopolitical endeavors without the same economic consequences faced by other nations. But this privilege comes at a cost: over-reliance on a currency system that, if challenged, could unravel the very fabric of the United States economy.

The BRICS Challenge: An Emerging Threat

The BRICS nations are no longer content to be bound by the dollar-centric system. With economic and political grievances mounting, they have explored the creation of a unified currency or a framework for trading in alternative currencies such as the yuan or ruble. While the logistics of implementing such a system are fraught with challenges—including the disparate economic models and strategic priorities of BRICS members—the intent is clear: to break free from the dollar’s grip.

Trump’s threats to impose tariffs on BRICS nations highlight Washington’s growing unease. By punishing nations that seek to undermine the dollar, the United States hopes to stave off the inevitable. Yet this strategy reeks of desperation. The BRICS bloc has economic resilience that the United States cannot easily counter. China, the world’s manufacturing hub, has already diversified its trade networks through its Belt and Road Initiative. India, a global leader in IT and services, has cultivated ties beyond Western markets. Russia, despite sanctions, maintains its grip on Europe’s energy supply. Even Brazil and South Africa, with their resource-driven economies, have alternatives to United States trade.

A One-Sided Dependency

While the United States dollar’s dominance gives Washington unparalleled power, it also exposes a critical vulnerability: the United States’ dependency on BRICS imports. From consumer goods supplied by China to critical minerals and energy resources from South Africa, Brazil, and Russia, the United States economy is fundamentally reliant on the very nations Trump is threatening.

Conversely, BRICS nations can reorient trade toward regional partners and emerging markets. This one-sided dependency leaves the United States in a precarious position. If BRICS nations decide to act collectively, the dollar’s fall would not just be a symbolic loss; it would trigger a seismic shift in the global economic order.

The Risks of Overreach

The United States has long weaponized its currency dominance to impose sanctions and exert control over the global financial system. But this overreach has driven many nations to seek alternatives, accelerating efforts to reduce dependency on the dollar. Recent moves by BRICS to trade in local currencies and increase gold reserves are early indicators of this shift.

If the dollar loses its reserve currency status, the consequences for the United States would be catastrophic. Without the ability to print money freely and sustain deficits, the country would face a harsh economic reckoning. Inflation would skyrocket, import costs would soar, and the United States would be forced to confront its chronic trade imbalance.

An Unsustainable Privilege

The dollar-centric system was never meant to last forever. It is, fundamentally, an arrangement sustained by faith. As BRICS and other nations grow weary of subsidizing the United States economy through this system, the cracks in the dollar’s dominance are becoming harder to ignore.

The United States must recognize the risks of its current path. Instead of doubling down on threats and sanctions, it should seek to reform its approach to global trade and finance. Cooperation, transparency, and fair competition—not coercion—are the keys to sustaining influence in a multipolar world.

The End of Dollar Hegemony?

The challenges posed by BRICS to the United States dollar are a wake-up call. For too long, the United States has relied on its currency dominance to mask structural economic vulnerabilities. As the world moves toward greater financial diversification, the dollar’s monopoly on global trade is under threat.

The fall of the dollar would not just mark the end of an era—it would fundamentally reshape the global order. Whether the United States can adapt to this new reality remains to be seen. One thing is certain: the days of unchecked dollar dominance are numbered, and the United States must prepare for a world where its currency is no longer king.