Revolut did not tell UK regulators CEO was listed as UAE resident

Regulators say Revolut failed to inform them before its CEO’s residency switch to the UAE appeared in corporate filings

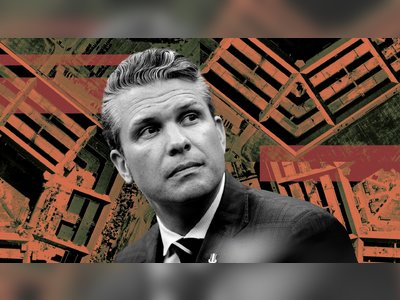

The UK-based fintech Revolut has come under fresh scrutiny after its chief executive and co-founder, Nik Storonsky, was formally listed as a resident of the United Arab Emirates in a corporate filing — a change which officials say was not communicated beforehand.

According to regulatory and Treasury sources, bodies including the Financial Conduct Authority and the Bank of England only became aware of the residency alteration after media reports disclosed it.

The change appears in filings relating to Storonsky’s family office; Revolut’s own filings continue to list him as UK-based.

Revolut, which serves some 65 million customers globally and recently received a provisional UK banking licence, insisted that Storonsky’s relocation had no bearing on his role or responsibilities.

A spokesperson said he divides his time across the UK and international markets, and emphasised that the company’s registered details remain in Britain.

But the timing — at a moment when Revolut is awaiting full banking authorisation — has alarmed regulators, who regard undisclosed changes in the domicile of key personnel as a material compliance and governance risk.

The revelation has prompted formal requests for explanations and assurances that the CEO’s new residency will not impair oversight or risk control.

Storonsky’s move is widely interpreted as part of a wider shift among wealthy executives reacting to the United Kingdom’s recent tax-policy changes: since the abolition of the “non-domiciled” tax status earlier this year, numerous high-net-worth individuals have relocated, often to jurisdictions such as the UAE that do not levy personal income or capital-gains tax.

But for Revolut, the relocation now carries regulatory weight.

As the fintech prepares for expansion and a potential public listing, UK authorities have underscored the need for full transparency — including timely notification of any changes in residency of top executives.

That, they say, is essential to ensure effective oversight, financial-crime controls and long-term stability of banks and payment providers operating under UK regulatory jurisdiction.

The coming weeks may determine whether this lapse proves a formal misstep or a minor housekeeping error.

Either way, its implications could reverberate across the fintech sector.

According to regulatory and Treasury sources, bodies including the Financial Conduct Authority and the Bank of England only became aware of the residency alteration after media reports disclosed it.

The change appears in filings relating to Storonsky’s family office; Revolut’s own filings continue to list him as UK-based.

Revolut, which serves some 65 million customers globally and recently received a provisional UK banking licence, insisted that Storonsky’s relocation had no bearing on his role or responsibilities.

A spokesperson said he divides his time across the UK and international markets, and emphasised that the company’s registered details remain in Britain.

But the timing — at a moment when Revolut is awaiting full banking authorisation — has alarmed regulators, who regard undisclosed changes in the domicile of key personnel as a material compliance and governance risk.

The revelation has prompted formal requests for explanations and assurances that the CEO’s new residency will not impair oversight or risk control.

Storonsky’s move is widely interpreted as part of a wider shift among wealthy executives reacting to the United Kingdom’s recent tax-policy changes: since the abolition of the “non-domiciled” tax status earlier this year, numerous high-net-worth individuals have relocated, often to jurisdictions such as the UAE that do not levy personal income or capital-gains tax.

But for Revolut, the relocation now carries regulatory weight.

As the fintech prepares for expansion and a potential public listing, UK authorities have underscored the need for full transparency — including timely notification of any changes in residency of top executives.

That, they say, is essential to ensure effective oversight, financial-crime controls and long-term stability of banks and payment providers operating under UK regulatory jurisdiction.

The coming weeks may determine whether this lapse proves a formal misstep or a minor housekeeping error.

Either way, its implications could reverberate across the fintech sector.