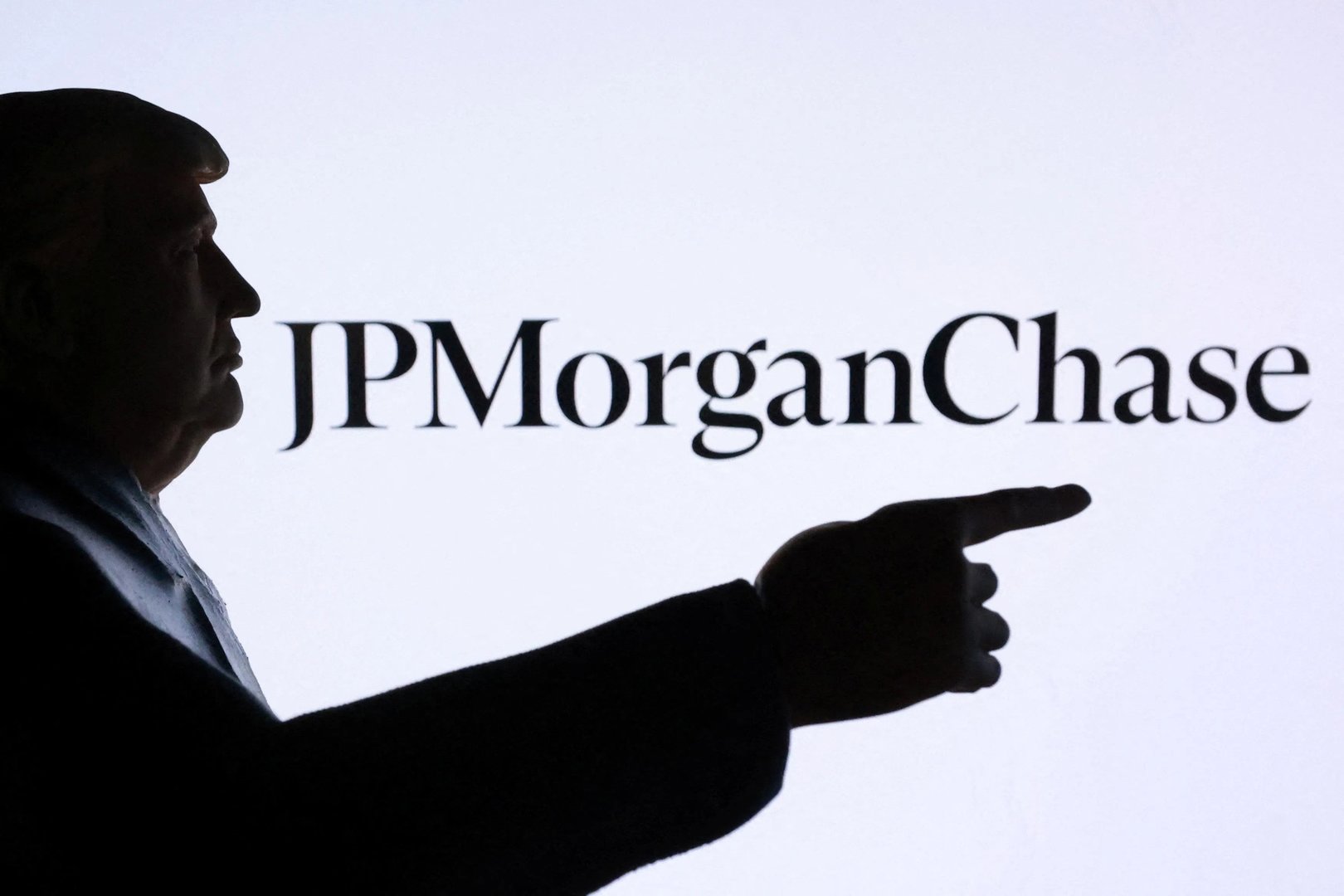

Trump Files $5 Billion Lawsuit Against JPMorgan Chase, Alleging Politically Motivated Account Closures

U.S. President accuses the nation’s largest bank and its CEO of 'debanking' him and his businesses in a legal action filed in Florida

President Donald Trump has initiated a high-stakes civil lawsuit seeking at least five billion dollars in damages from JPMorgan Chase and its chief executive, Jamie Dimon, asserting that the banking giant unlawfully terminated his personal and business accounts for political reasons.

The complaint, filed on January 22 in Miami-Dade County Court in Florida, contends that the bank’s actions shortly after the January 6, 2021 events at the U.S. Capitol amounted to discriminatory “debanking” designed to punish his political views and conservative affiliations, disrupting his financial operations and inflicting reputational harm.

In the legal filing, Trump’s attorneys argue that the bank’s decision to close multiple accounts in early 2021 — allegedly with minimal notice and without adequate justification — was driven by a perception within the institution that distancing itself from the former president and his enterprises would be advantageous amid the political climate at the time.

The suit accuses JPMorgan Chase of breaching contractual obligations, acting in bad faith and violating consumer protection statutes in Florida by curtailing essential financial services to Trump and related entities.

It further asserts that Dimon himself played a role in allegedly harming Trump’s commercial reputation and influencing other financial institutions to avoid doing business with him.

JPMorgan Chase has strongly denied the allegations, emphasizing that it does not close customer accounts on the basis of political or religious beliefs.

The bank’s statement reaffirmed that decisions to end banking relationships are grounded in assessments of legal, regulatory or risk-based factors, and it said it respects the president’s right to pursue legal recourse while defending its own practices in court.

The institution has also noted its engagement with regulators, including previous administrations and the current U.S. government, on evolving regulatory expectations and risk management standards.

The lawsuit emerges amid broader debate over “debanking” and banking practices, with Trump and other public figures challenging large financial institutions’ risk-based decisions as ideologically motivated.

The case is expected to prompt intensive legal scrutiny of the boundaries between risk management and alleged discriminatory conduct in the financial services sector, and could influence future regulatory and industry standards regarding access to banking services.

The complaint, filed on January 22 in Miami-Dade County Court in Florida, contends that the bank’s actions shortly after the January 6, 2021 events at the U.S. Capitol amounted to discriminatory “debanking” designed to punish his political views and conservative affiliations, disrupting his financial operations and inflicting reputational harm.

In the legal filing, Trump’s attorneys argue that the bank’s decision to close multiple accounts in early 2021 — allegedly with minimal notice and without adequate justification — was driven by a perception within the institution that distancing itself from the former president and his enterprises would be advantageous amid the political climate at the time.

The suit accuses JPMorgan Chase of breaching contractual obligations, acting in bad faith and violating consumer protection statutes in Florida by curtailing essential financial services to Trump and related entities.

It further asserts that Dimon himself played a role in allegedly harming Trump’s commercial reputation and influencing other financial institutions to avoid doing business with him.

JPMorgan Chase has strongly denied the allegations, emphasizing that it does not close customer accounts on the basis of political or religious beliefs.

The bank’s statement reaffirmed that decisions to end banking relationships are grounded in assessments of legal, regulatory or risk-based factors, and it said it respects the president’s right to pursue legal recourse while defending its own practices in court.

The institution has also noted its engagement with regulators, including previous administrations and the current U.S. government, on evolving regulatory expectations and risk management standards.

The lawsuit emerges amid broader debate over “debanking” and banking practices, with Trump and other public figures challenging large financial institutions’ risk-based decisions as ideologically motivated.

The case is expected to prompt intensive legal scrutiny of the boundaries between risk management and alleged discriminatory conduct in the financial services sector, and could influence future regulatory and industry standards regarding access to banking services.