Debate Intensifies Over Trump Administration’s Consideration of an Australian-Style Retirement System

As the U.S. evaluates adopting elements of Australia’s compulsory superannuation model, experts contrast potential benefits and structural challenges for American workers

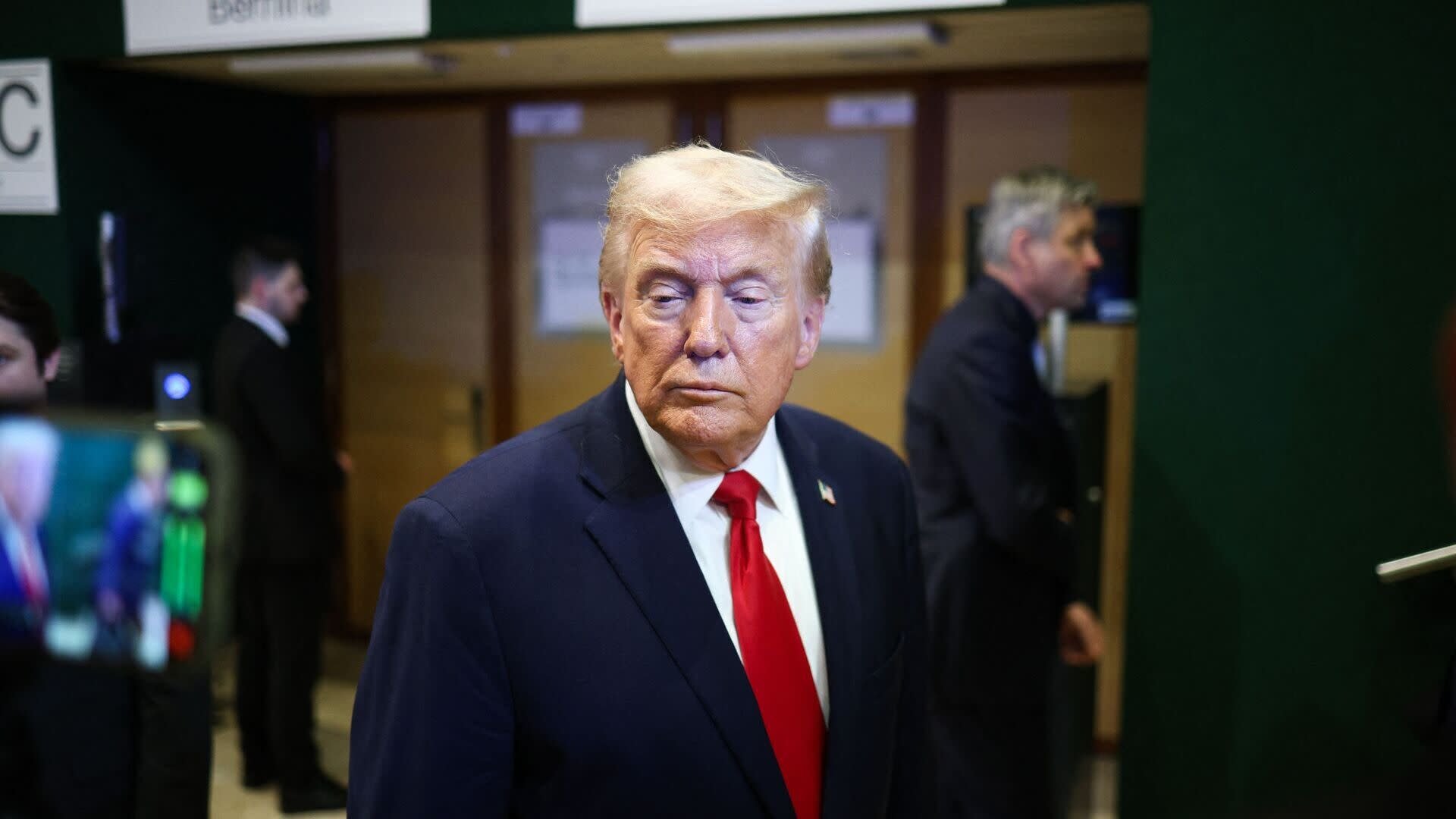

The Trump administration has signalled it is seriously evaluating the feasibility of introducing an Australian-style retirement savings system for American workers, prompting debate in Washington and among retirement policy experts about whether such a model could outperform or undermine the existing U.S. framework.

At the core of the discussion is Australia’s compulsory superannuation system — a model in which employers must contribute a mandated share of workers’ wages into professionally managed retirement funds that are preserved until retirement age.

President Donald Trump has described the concept as a “good plan” that “has worked out very well,” but detailed policy proposals from the administration remain in early stages as officials weigh potential integration with existing U.S. retirement programs.

Australia’s superannuation system, introduced in the early 1990s, obliges employers to contribute a minimum percentage of earnings — currently around twelve percent — into retirement accounts for their employees, which has helped generate one of the largest pools of pension assets globally.

The system’s broad coverage and compulsory nature have driven high participation rates and comparatively robust asset accumulation for workers nearing retirement.

Supporters of adapting this model argue that mandatory contributions could address significant gaps in the American retirement landscape, where many workers lack access to employer-sponsored plans and reliance on voluntary 401(k) arrangements has left millions without adequate savings.

However, analysts caution that structural and contextual differences between the U.S. and Australian systems could complicate direct adoption.

The U.S. Social Security programme provides an inflation-protected, defined benefit floor that offers lifetime income to retirees, a feature absent in Australia’s predominantly defined-contribution superannuation system.

Critics of an Australian-style transplant note that compulsory accounts do not guarantee lifetime income and expose workers to market risk, and that transition challenges — including how to integrate mandatory contributions alongside Social Security’s financing structure — would require substantial political and legislative effort.

Experts also highlight that, despite its strengths, Australia’s model has shortcomings, including potential “adequacy gaps” for certain earners and limited incentives for converting accumulated balances into reliable retirement income streams.

While an Australian-inspired system might foster greater savings discipline and broaden coverage, its compatibility with existing U.S. retirement security mechanisms and demographic trends remains under scrutiny.

As the Trump administration continues its evaluation, policymakers and stakeholders are likely to debate how best to balance compulsory savings, employer participation, and the preservation of Social Security’s foundational protections in any future U.S. retirement reform.

At the core of the discussion is Australia’s compulsory superannuation system — a model in which employers must contribute a mandated share of workers’ wages into professionally managed retirement funds that are preserved until retirement age.

President Donald Trump has described the concept as a “good plan” that “has worked out very well,” but detailed policy proposals from the administration remain in early stages as officials weigh potential integration with existing U.S. retirement programs.

Australia’s superannuation system, introduced in the early 1990s, obliges employers to contribute a minimum percentage of earnings — currently around twelve percent — into retirement accounts for their employees, which has helped generate one of the largest pools of pension assets globally.

The system’s broad coverage and compulsory nature have driven high participation rates and comparatively robust asset accumulation for workers nearing retirement.

Supporters of adapting this model argue that mandatory contributions could address significant gaps in the American retirement landscape, where many workers lack access to employer-sponsored plans and reliance on voluntary 401(k) arrangements has left millions without adequate savings.

However, analysts caution that structural and contextual differences between the U.S. and Australian systems could complicate direct adoption.

The U.S. Social Security programme provides an inflation-protected, defined benefit floor that offers lifetime income to retirees, a feature absent in Australia’s predominantly defined-contribution superannuation system.

Critics of an Australian-style transplant note that compulsory accounts do not guarantee lifetime income and expose workers to market risk, and that transition challenges — including how to integrate mandatory contributions alongside Social Security’s financing structure — would require substantial political and legislative effort.

Experts also highlight that, despite its strengths, Australia’s model has shortcomings, including potential “adequacy gaps” for certain earners and limited incentives for converting accumulated balances into reliable retirement income streams.

While an Australian-inspired system might foster greater savings discipline and broaden coverage, its compatibility with existing U.S. retirement security mechanisms and demographic trends remains under scrutiny.

As the Trump administration continues its evaluation, policymakers and stakeholders are likely to debate how best to balance compulsory savings, employer participation, and the preservation of Social Security’s foundational protections in any future U.S. retirement reform.