HSBC Seeks to Rebuild Its Hong Kong IPO Business After Missing Out on 2025 Listings Boom

The bank shifts strategic focus to capture a larger share of Hong Kong’s vibrant equity capital markets amid strong fundraising activity

HSBC has announced a renewed strategic drive to expand its role in Hong Kong’s initial public offering market after participating in only a single listing during the city’s exceptional 2025 equities boom.

The bank’s leadership acknowledged that despite Hong Kong raising HK$286 billion in IPO proceeds last year, it lagged behind major competitors in securing lead sponsorship roles, highlighting talent gaps and the impact of earlier exits from parts of its investment banking operations in Europe and the United States.

This shortfall has prompted senior executives to reprioritise Asia’s largest financial centre as a core focus for growth in equity capital markets, aiming to strengthen the bank’s relevance and capture a greater share of future issuance.

Senior bankers at HSBC described the effort to rebuild market share as “maniacally focused,” with specific plans to bolster the firm’s Hong Kong investment banking division by hiring experienced Chinese bankers and deepening relationships with issuers planning listings on the Hong Kong Exchange.

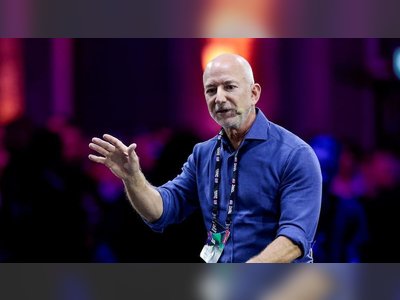

The shift forms part of a broader pivot under Chief Executive Georges Elhedery, who has emphasised Asia and the Middle East as high-growth regions to offset slower activity in traditional Western markets.

Under this strategy, HSBC aims to elevate its position in equity capital markets league tables and compete more effectively with rivals such as Morgan Stanley, JPMorgan and China International Capital Corporation, which dominated the region’s IPO sponsorship roles last year.

The renewed focus comes in the context of a broader resurgence of Hong Kong’s capital markets after years of subdued issuance elsewhere.

With mainland Chinese firms and global issuers returning to list in the city, HSBC’s pivot underscores the bank’s intent to leverage robust market fundamentals and regulatory support that have helped Hong Kong reclaim its role as a leading global listing venue.

Bank executives have indicated that capturing a larger slice of this opportunity will require not only expanded human capital but also deeper engagement with institutional and corporate clients in the region, positioning HSBC to benefit from anticipated future IPO activity and the continued growth of Asia’s equity markets.

The bank’s leadership acknowledged that despite Hong Kong raising HK$286 billion in IPO proceeds last year, it lagged behind major competitors in securing lead sponsorship roles, highlighting talent gaps and the impact of earlier exits from parts of its investment banking operations in Europe and the United States.

This shortfall has prompted senior executives to reprioritise Asia’s largest financial centre as a core focus for growth in equity capital markets, aiming to strengthen the bank’s relevance and capture a greater share of future issuance.

Senior bankers at HSBC described the effort to rebuild market share as “maniacally focused,” with specific plans to bolster the firm’s Hong Kong investment banking division by hiring experienced Chinese bankers and deepening relationships with issuers planning listings on the Hong Kong Exchange.

The shift forms part of a broader pivot under Chief Executive Georges Elhedery, who has emphasised Asia and the Middle East as high-growth regions to offset slower activity in traditional Western markets.

Under this strategy, HSBC aims to elevate its position in equity capital markets league tables and compete more effectively with rivals such as Morgan Stanley, JPMorgan and China International Capital Corporation, which dominated the region’s IPO sponsorship roles last year.

The renewed focus comes in the context of a broader resurgence of Hong Kong’s capital markets after years of subdued issuance elsewhere.

With mainland Chinese firms and global issuers returning to list in the city, HSBC’s pivot underscores the bank’s intent to leverage robust market fundamentals and regulatory support that have helped Hong Kong reclaim its role as a leading global listing venue.

Bank executives have indicated that capturing a larger slice of this opportunity will require not only expanded human capital but also deeper engagement with institutional and corporate clients in the region, positioning HSBC to benefit from anticipated future IPO activity and the continued growth of Asia’s equity markets.