U.S. Treasury Warns China Could Challenge American Digital Asset Dominance via Hong Kong

Washington expresses concern that Beijing’s expansion of digital asset initiatives in Hong Kong may erode U.S. leadership in cryptocurrency innovation and regulation

The United States Treasury has cautioned that China could be poised to challenge U.S. leadership in the rapidly evolving digital asset sector by leveraging Hong Kong’s emerging role as a regulated crypto hub.

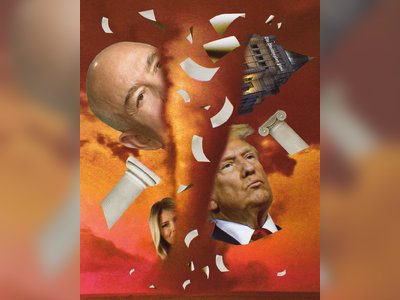

Testifying before the Senate Banking Committee, Treasury Secretary Scott Bessent said he would “not be surprised” if Chinese authorities are exploring mechanisms to rival American influence in digital assets, given Hong Kong’s active development of regulatory infrastructure and licensing frameworks.

This warning reflects concerns in Washington about maintaining the United States’ competitive edge in blockchain technology and stablecoins at a time when global digital finance markets are maturing.

Bessent’s remarks came during questioning about broader geopolitical competition in finance, including whether Beijing is seeking to build alternatives to American financial leadership through digital assets.

He noted rumours that Chinese initiatives — potentially backed by assets other than the yuan such as gold — are being discussed, though he acknowledged that definitive information is lacking.

Secretary Bessent emphasised that the U.S. aims to remain the pre-eminent crypto jurisdiction by advancing regulatory clarity and supporting private sector innovation, including through recently enacted laws such as the Genius Act, which establishes a framework for stablecoin issuers.

Despite China’s longstanding ban on cryptocurrency trading and mining on the mainland, Hong Kong has taken a differing approach by creating a licensing regime for virtual asset trading platforms and stablecoin issuers.

Authorities in the city have also approved regulated products such as ETFs linked to major cryptocurrencies, drawing interest from firms seeking compliant digital asset exposure.

Analysts say this regulatory openness has positioned Hong Kong as a potential conduit for digital finance innovation and could attract both regional and global capital interested in blockchain-based products.

Bessent stressed that American policy will focus on balancing robust safeguards with enabling industry growth, arguing that the U.S. private sector and its dollar-linked stablecoins represent a well-regulated alternative to state-driven digital money projects.

He also highlighted bipartisan efforts to advance further legislative frameworks for digital assets, underscoring the administration’s commitment to securing America’s leadership in the sector.

The Treasury chief’s comments underscore a broader strategic competition in financial technology between Washington and Beijing, with Hong Kong’s evolving role in digital assets adding a new dimension to global economic rivalry.

Testifying before the Senate Banking Committee, Treasury Secretary Scott Bessent said he would “not be surprised” if Chinese authorities are exploring mechanisms to rival American influence in digital assets, given Hong Kong’s active development of regulatory infrastructure and licensing frameworks.

This warning reflects concerns in Washington about maintaining the United States’ competitive edge in blockchain technology and stablecoins at a time when global digital finance markets are maturing.

Bessent’s remarks came during questioning about broader geopolitical competition in finance, including whether Beijing is seeking to build alternatives to American financial leadership through digital assets.

He noted rumours that Chinese initiatives — potentially backed by assets other than the yuan such as gold — are being discussed, though he acknowledged that definitive information is lacking.

Secretary Bessent emphasised that the U.S. aims to remain the pre-eminent crypto jurisdiction by advancing regulatory clarity and supporting private sector innovation, including through recently enacted laws such as the Genius Act, which establishes a framework for stablecoin issuers.

Despite China’s longstanding ban on cryptocurrency trading and mining on the mainland, Hong Kong has taken a differing approach by creating a licensing regime for virtual asset trading platforms and stablecoin issuers.

Authorities in the city have also approved regulated products such as ETFs linked to major cryptocurrencies, drawing interest from firms seeking compliant digital asset exposure.

Analysts say this regulatory openness has positioned Hong Kong as a potential conduit for digital finance innovation and could attract both regional and global capital interested in blockchain-based products.

Bessent stressed that American policy will focus on balancing robust safeguards with enabling industry growth, arguing that the U.S. private sector and its dollar-linked stablecoins represent a well-regulated alternative to state-driven digital money projects.

He also highlighted bipartisan efforts to advance further legislative frameworks for digital assets, underscoring the administration’s commitment to securing America’s leadership in the sector.

The Treasury chief’s comments underscore a broader strategic competition in financial technology between Washington and Beijing, with Hong Kong’s evolving role in digital assets adding a new dimension to global economic rivalry.