US Retirement Reform Debate Gains Traction as Trump Administration Eyes Australian-Style Model

Proposal inspired by Australia’s compulsory superannuation system emerges as a potential solution for tens of millions of American workers lacking retirement savings

The United States is witnessing an intensifying discussion over retirement security as the Trump administration publicly explores a policy framework inspired by Australia’s compulsory retirement savings model amid concern about the adequacy of retirement savings for millions of American workers.

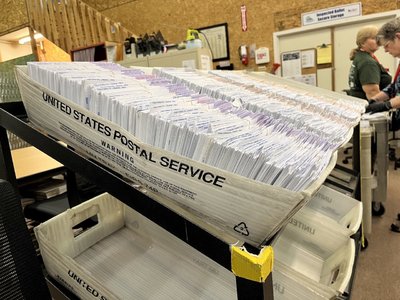

At the centre of the debate is the Retirement Savings for Americans Act, a legislative proposal that draws on the Australian principle of universality — automatic participation and broad coverage for all workers — to help expand retirement savings for an estimated 69 million Americans who currently lack adequate retirement plans.

This initiative reflects growing bipartisan recognition of long-standing structural challenges in the U.S. system, where reliance on voluntary employer-sponsored plans such as 401(k)s has left significant portions of the workforce without meaningful retirement security and where the long-term viability of Social Security remains under pressure.

Australia’s “superannuation” program, established in the early 1990s, requires employers to contribute a defined percentage of workers’ earnings into private retirement funds, with the current guarantee set at 12 per cent of ordinary income.

Proponents argue this compulsory contribution model has succeeded in generating high retirement savings participation rates and substantial asset pools, offering a compelling point of reference for U.S. policymakers seeking to enhance retirement readiness.

Australian superannuation has grown into one of the world’s largest pension pools, reinforcing perceptions among U.S. officials that a similar structure could strengthen retirement outcomes for American workers if adapted thoughtfully to domestic conditions.

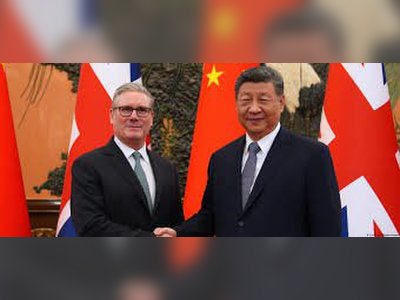

President Donald Trump has publicly characterised the Australian system as a “good plan” and stated his administration is examining how its core elements might translate to the U.S. context, noting it has “worked out very well” and merits serious consideration as part of broader retirement policy discussions.

Advocates of an Australia-inspired model contend that automatic, guaranteed contributions by employers could reduce coverage gaps and build retirement assets for workers who currently lack access to employer-sponsored plans.

They emphasise that such a system could complement, rather than replace, existing 401(k) arrangements and Social Security, aiming to broaden participation while preserving choices for individuals who wish to save more.

While the conversation is still in early stages and no legislative language implementing a compulsory contribution mandate has been enacted, the very fact that the proposal is gaining traction reflects a mounting consensus that innovative reforms may be required to ensure long-term retirement security for U.S. workers.

Should the United States move toward a retirement framework with features akin to Australia’s superannuation, it would mark a significant evolution in national retirement policy and a potential template for expanding universal coverage and financial resilience in an ageing society.

At the centre of the debate is the Retirement Savings for Americans Act, a legislative proposal that draws on the Australian principle of universality — automatic participation and broad coverage for all workers — to help expand retirement savings for an estimated 69 million Americans who currently lack adequate retirement plans.

This initiative reflects growing bipartisan recognition of long-standing structural challenges in the U.S. system, where reliance on voluntary employer-sponsored plans such as 401(k)s has left significant portions of the workforce without meaningful retirement security and where the long-term viability of Social Security remains under pressure.

Australia’s “superannuation” program, established in the early 1990s, requires employers to contribute a defined percentage of workers’ earnings into private retirement funds, with the current guarantee set at 12 per cent of ordinary income.

Proponents argue this compulsory contribution model has succeeded in generating high retirement savings participation rates and substantial asset pools, offering a compelling point of reference for U.S. policymakers seeking to enhance retirement readiness.

Australian superannuation has grown into one of the world’s largest pension pools, reinforcing perceptions among U.S. officials that a similar structure could strengthen retirement outcomes for American workers if adapted thoughtfully to domestic conditions.

President Donald Trump has publicly characterised the Australian system as a “good plan” and stated his administration is examining how its core elements might translate to the U.S. context, noting it has “worked out very well” and merits serious consideration as part of broader retirement policy discussions.

Advocates of an Australia-inspired model contend that automatic, guaranteed contributions by employers could reduce coverage gaps and build retirement assets for workers who currently lack access to employer-sponsored plans.

They emphasise that such a system could complement, rather than replace, existing 401(k) arrangements and Social Security, aiming to broaden participation while preserving choices for individuals who wish to save more.

While the conversation is still in early stages and no legislative language implementing a compulsory contribution mandate has been enacted, the very fact that the proposal is gaining traction reflects a mounting consensus that innovative reforms may be required to ensure long-term retirement security for U.S. workers.

Should the United States move toward a retirement framework with features akin to Australia’s superannuation, it would mark a significant evolution in national retirement policy and a potential template for expanding universal coverage and financial resilience in an ageing society.