Biden Blocks Nippon Steel’s $14.9 Billion Takeover of U.S. Steel

The U.S. President cites national security concerns in rejecting the Japanese firm’s acquisition of the storied American steelmaker.

U.S. President Joe Biden has blocked Nippon Steel’s proposed $14.9 billion acquisition of U.S. Steel, citing national security concerns.

The decision, announced on Friday, ends a year-long review of the deal and marks a significant blow to the Japanese company’s efforts to expand globally.

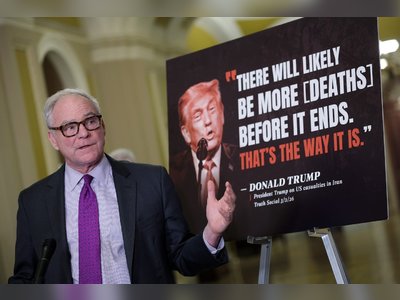

The deal, initially announced in December 2023, faced immediate political opposition, with both then-candidate Donald Trump and President Biden pledging to prevent the takeover of U.S. Steel.

The Pittsburgh-based steelmaker, once a dominant force in American industry, is now the country’s third-largest steel producer and ranks 24th globally.

'A strong domestically owned and operated steel industry represents an essential national security priority,' Biden said in a statement, emphasizing the importance of domestic steel production for resilient supply chains.

Fierce Opposition and Fallout

Nippon Steel, the world’s fourth-largest steelmaker, had offered significant concessions to secure approval, including moving its U.S. headquarters to Pittsburgh and giving the U.S. government veto power over production changes.

Despite these measures, the deal was rejected, prompting sharp criticism from both companies.

U.S. Steel CEO David Burritt labeled Biden’s decision 'shameful and corrupt,' while Nippon Steel called it a 'clear violation of due process.'

The United Steelworkers union, which opposed the merger, praised the decision.

Union President David McCall called it 'the right move for our members and our national security.' Meanwhile, Japanese Industry Minister Yoji Muto expressed disappointment, warning of potential repercussions for future U.S.-Japan investments.

Economic and Strategic Implications

The rejection comes amid broader concerns about economic ties with key allies and the global steel industry’s challenges.

Japan, a critical U.S. ally in the Indo-Pacific, had pushed for the deal, with Japanese Prime Minister Shigeru Ishiba previously urging Biden to approve it to bolster economic cooperation.

The collapse of the deal leaves U.S. Steel in a precarious position.

The company has reported nine consecutive quarters of declining profits amid a global downturn in steel demand.

Potential alternative buyers, such as Cleveland-Cliffs, face their own financial struggles.

Nippon Steel now faces a $565 million penalty for the deal’s collapse and must reevaluate its overseas growth strategy.

The acquisition was intended to boost its global output capacity to 85 million metric tons annually, closer to its long-term goal of 100 million tons.

Political Reactions

Biden’s decision drew mixed reactions.

Democratic lawmakers praised the move, with Senator Sherrod Brown calling the deal 'a clear threat to America’s national and economic security.' However, critics, including former Obama adviser Jason Furman, argued the decision undermines U.S. economic interests and damages relations with allies.

The Committee on Foreign Investment in the United States had reviewed the deal for months but referred the decision to Biden in December, citing unresolved security concerns.

The case underscores the complex intersection of economic policy, geopolitics, and national security in the U.S. steel industry, with broader implications for international trade and investment.

The decision, announced on Friday, ends a year-long review of the deal and marks a significant blow to the Japanese company’s efforts to expand globally.

The deal, initially announced in December 2023, faced immediate political opposition, with both then-candidate Donald Trump and President Biden pledging to prevent the takeover of U.S. Steel.

The Pittsburgh-based steelmaker, once a dominant force in American industry, is now the country’s third-largest steel producer and ranks 24th globally.

'A strong domestically owned and operated steel industry represents an essential national security priority,' Biden said in a statement, emphasizing the importance of domestic steel production for resilient supply chains.

Fierce Opposition and Fallout

Nippon Steel, the world’s fourth-largest steelmaker, had offered significant concessions to secure approval, including moving its U.S. headquarters to Pittsburgh and giving the U.S. government veto power over production changes.

Despite these measures, the deal was rejected, prompting sharp criticism from both companies.

U.S. Steel CEO David Burritt labeled Biden’s decision 'shameful and corrupt,' while Nippon Steel called it a 'clear violation of due process.'

The United Steelworkers union, which opposed the merger, praised the decision.

Union President David McCall called it 'the right move for our members and our national security.' Meanwhile, Japanese Industry Minister Yoji Muto expressed disappointment, warning of potential repercussions for future U.S.-Japan investments.

Economic and Strategic Implications

The rejection comes amid broader concerns about economic ties with key allies and the global steel industry’s challenges.

Japan, a critical U.S. ally in the Indo-Pacific, had pushed for the deal, with Japanese Prime Minister Shigeru Ishiba previously urging Biden to approve it to bolster economic cooperation.

The collapse of the deal leaves U.S. Steel in a precarious position.

The company has reported nine consecutive quarters of declining profits amid a global downturn in steel demand.

Potential alternative buyers, such as Cleveland-Cliffs, face their own financial struggles.

Nippon Steel now faces a $565 million penalty for the deal’s collapse and must reevaluate its overseas growth strategy.

The acquisition was intended to boost its global output capacity to 85 million metric tons annually, closer to its long-term goal of 100 million tons.

Political Reactions

Biden’s decision drew mixed reactions.

Democratic lawmakers praised the move, with Senator Sherrod Brown calling the deal 'a clear threat to America’s national and economic security.' However, critics, including former Obama adviser Jason Furman, argued the decision undermines U.S. economic interests and damages relations with allies.

The Committee on Foreign Investment in the United States had reviewed the deal for months but referred the decision to Biden in December, citing unresolved security concerns.

The case underscores the complex intersection of economic policy, geopolitics, and national security in the U.S. steel industry, with broader implications for international trade and investment.